Unicorns and Atomic Habits

There are stories about “unicorn” grads that explode out of university, landing offers for internships and placement, ending up with multiple offers in year three; perhaps someone in your class will be a unicorn. But what you may not know is that you have as equitable chance as anyone of landing that dream job; the most important attribute is hustle and graft. And hustle and graft are a choice you make.

The question is, with all that’s going on around you at university, how can you find the time to develop into a unicorn? In this post we’ll talk about the outcome (a great job), how to frame the job problem and what you can do to give yourself the very best chance of success. In the end we want more unicorns at Southampton Business School, maybe we’ll need another name!

Unicorn Step 1 – Think ‘Employability’ over ‘Employed’

Before we’re employed, we must become employable. For that we can learn a lot from sports about to develop high performance cultures. Bill Walsh’s ‘the score looks after itself’ is a great place to start. His performance culture starts first thing in the morning and ends at night, and it ensures you’re advancing at every point in the day. You can’t just walk up as a batter in baseball and swing harder, you need to build the muscle memory in advance. The same applies at interview, the interview is a last step, all the evidence of employability is gathered well in advance.

“There is no guarantee, no ultimate formula for success. It all comes down to intelligently and relentlessly seeking solutions that will increase your chance of prevailing. When you do that, the job will take care of itself.”

If you are employable, you (probably) will get employed. But without building a strong case to get that dream offer it’s hard to imagine you’d get a call back. 99% students ask the question ‘how can I get a job’ few ask “what can I do (every day!) that will make me more employable?” In the prior blog I described the importance of experimentation, that certainly will help. The more you build ‘muscle memory’ in leadership, organisation, mentorship and getting stuff done, the more you’ll know what employers are looking for in candidates.

Before I left BlackRock I asked leadership what they could do with more of in graduates, universally they say, ‘give me a grad who can solve problems’. No one said, ‘explain principal component analysis’ or ‘describe the efficient frontier’. So don’t be the student who swallowed the curriculum but doesn’t know what to do with it, find ways to add value to your degree as an individual, make your application ‘pop’ around the edges.

Unicorn Step 2 – The Power of Habit

Like any success story, there are hundreds of factors that lead to a ‘unicorn’ grad’s success. But almost certainly one of the most important the power of habit.

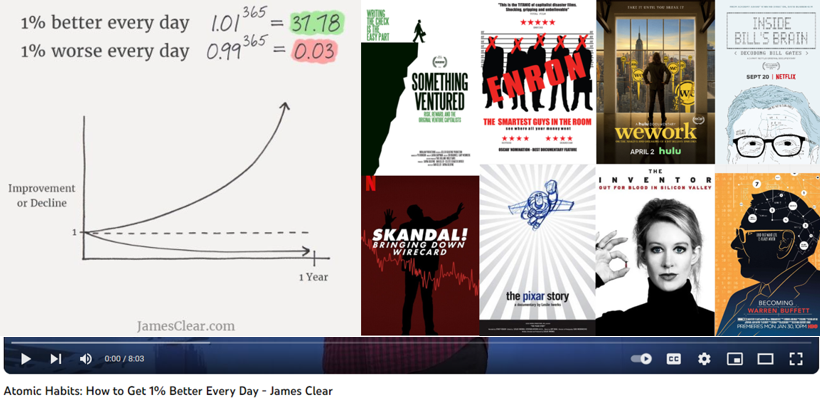

Think about the stats in the chart at the top of the page. If you did 1% of extra effort a day, you could have 37 times more in a year. Perhaps that multiple is unrealistic, but since learning is compounding there’s something to it. YOU can get 37 times better at a thing YOU chose, think about, you can become seriously differentiated vs your peers who ‘swallowed the curriculum’. Fortunately, we have CEPAR who can help us, there’s SUSU and other great resources.

Here’s why the habits approach works so well: Think about the irritating ‘unicorn’ grad at your assessment centre at Goldman Sachs, how did get they so proficient? For example…

- they used the terms ‘buy’ and ‘sell’ side as if they’re general terms (they are in the city, and we’ll cover in another blog)

- they wanted to be an investor not a trader (they’re very different and you need to know the difference to be credible, ditto another blog)

- they built things so fast in a coding test (because coding is learnt by doing)

They did it by committing time to reading the financial press (we all have free access to the FT), finding the valuable ‘follows’ on LinkedIn and keying into the best books and media. Here’s how you can apply this approach to your time at Southampton Business School. As a fintech Enterprise fellow these focus on finance, but the principles apply to all degrees.

Unicorn Step 3 – Do the Work

Plant Seeds for Thought

If you are limited to a minute a day, you need to scale how you discover relevant content. The best way to do that is to get engaged on LinkedIn and follow, some ideas below (remembering that these may not always be open to employment, but will publish relevant content)

- Companies

- Student Centred Support

-

- Finance – The Skills Workshop, Investment2020 < expand via google

- General – The Bright Network

- Individuals

-

- Amplify Trading’s Anthony Cheung

Enrich Base Knowledge

Once you’ve had your feed top up over breakfast, think about other sources of more ‘chewy’ media. The FT can be a great source of interesting articles on capital markets, sustainability, regulation and the economy, Wired for tech. And if you don’t fancy the ‘long read’ consume podcasts, there are many, often from the big investment banks about their positioning around the short and long term economic conditions.

- Podcasts

-

- Finance – Morgan Stanley, Goldman Sachs, JP Morgan < expand via google

- Consulting – Harvard Business Review

- Tech – ThoughtWorks, SnowFlake

Edutain Yourself

Finally, over the holidays or whilst chilling on the weekend check out some industry relevant dramatisations (not listed because some contain adult materials!) and documentaries.

- Documentaries

- Authors

-

- Multiple easy read books around finance – Michael Lewis

If you eat these small, medium and large sized fuel for your curiosity you’ll get a much better understanding of what goes on in high finance, you won’t notice you did it and you’ll be massively more credible at interview.

What Next

Remember these tips are backed by my experiences as a Barclay’s investment bank grad in 1998. As a grad trainee I got a ‘firehose’ approach to training (Barclays shipped me a ton of material to consume before I even joined). My first rotation was in Futures tech and as I got into it I wanted something more digestible that would be interesting but level up my knowledge about how banks really worked. Just because it was on the shelf in Canary Wharf I turned to Fiasco: The Inside Story of a Wall Street Trader

“FIASCO is the first book to take on the derivatives trading industry, the most highly charged and risky sector of the stock market. More importantly, it is a blistering indictment of the largely unregulated market in derivatives and serves as a warning to unwary investors about real fiascos, which have cost billions of dollars.”

High octane stuff and part of my 1% atomic habit process (although that wasn’t a thing at the time) That’s how to become the unicorn grad and the best part about using these habits is that they (mostly) come for free and (oftentimes) is the most fun we can have learning. So take a moment to watch and reflect on this from James Clear, author of Atomic Habits and then put it to work.

Atomic Habits: How to Get 1% Better Every Day – James Clear

Blog by Dr Simon Troup