Respecting The Game

If you read another of AOB post you’ll understand the power of experimentation, it’s hard to know what you should do with your life if you haven’t cracked the puzzle of motive and purpose. It’s also super important as student not to forget to enjoy yourself; I generally encourage undergraduates to live an unconstrained year 1, to join societies, to ask plenty of questions of their lecturers, basically attack life with an attitude of ‘if you don’t like it, try it, you might like it’.

As you head into year 2, what next? More experimentation? (Yes!!) Keep questioning and be curious? (of course!), but something changes, you are now entering the game of spring weeks, internships, assessment centres and graduate offers. That game is particularly structured if you if you are shooting for larger company’s ’prime-time’ internships, placements and graduate schemes.

In this post, I’ll explain how the first half of the game is played (generally) and the critical gates for you to progress. Fair warning, one thing you won’t get out of this post is specifics about applications. Why? Because our central careers team and CEPAR have great resources, and (generally) the applications are designed to be simple workflows, they’re not intended to confuse.

Before we dive in, two things, for this blog I’m leveraging BlackRock’s process since its typical of consulting, accounting and financial services. So, think about all I say in general terms for any sector (pharma, telcos, automotive), anyway, here we go, action one……….

Action One (Summer): Reflect & Collect

Let’s assume you are seeking the most competitive roles for an internship, for example ‘bulge bracket’ investment banks, accountants and consultancies. The deadline for the most those can be as early as end of October, certainly November for investment roles, which doesn’t leave a lot of time to get organised! So, the first step is to organise yourself around the problem. If you have the energy, this starts in the summer when you may have the gift of time, use it!

- LinkedIn – Follow, Follow, Follow. Follow companies at the start of the summer, most will announce applications open with a post. Get some searches saved for example ‘accounting/internships/London’ etc, you’ll then get notified as they kick in. For LinkedIn also think bright network, rate-my-placement and other platforms.

- Reflect – Now you’ll be alerted if something happens, take some time to reflect on your experiences of the prior year, make sure you understand YOUR purpose in life. Why? Firstly, so you get the right job and secondly because you’ll almost certainly be asked about what makes you excited to work at a given employer.

- Research – You have a finite amount of time (and sanity); given reflections on your purpose, identify the firms that best align with you. Don’t follow friends and peers, or apply for hollow lifestyle motives (money, glory & power!). Make sure you’re applying to companies YOU can build a resilient and sustainable relationship with. Candidates that align well with values and skillsets tend to shine at interview, do not fake it.

- Collect – Become a collector. Accounting for the sector and companies you will target, collect thoughts and ideas that can support your applications and start writing some stories down (say in a google doc on your phone). They’ll provide the scaffolding for (many!) applications. The earlier you capture them, the more time you have to evolve them into punchy narratives that ‘pop’ in applications.

I strongly encourage you to find time to write down the stories/evidence you collect over the summer. Why? The best draft is never the first, and when you read your own work invariably, you cringe (I do!). So ‘get out of your own way’ and keep it simple with a google doc or similar, make it easy to note things down, and lock out time to read back every week.

By the end of the summer those snippets will be shorter, read better and ‘pop’ for assessors. Remove the fluff and get them sharp and on point. That’s far better than wrestling them at the last minute in Goldman Sachs’ application portal under a state of panic!

Action Two (September-ish) – Learn & Respect the Game

If you are dead set on landing that ‘prime-time’ internship, one that offers a structured summer experience whilst being paid a competitive salary and with a strong chance of an offer; you need to know how the game is played. These internships are effectively the ‘try before you buy’ strategy of the big employers. Action two is all about understanding how to play that game, we’ll use BlackRock’s process as an example.

Level 1 –Virtual Events – Firms want you to succeed in your applications, most will offer lots of on-line opportunities to hear about their culture, process, and support applications. Sign up where you can and soak up the insights, they should lead to better aligned applications and often apply broadly across other employers and sectors.

Level 2 – Spring Week –BlackRock >> “the Spring Insight Program provides a week-long, in-depth look at our business. You’ll experience life at BlackRock through classroom sessions, work-shadowing, networking and social events. The Spring Insight Program acts as a feeder for the Summer Internship Program.” << joining a spring week is the first opportunity to engage with impact to demonstrate your potential, sometimes face-to-face.

Level 3 – Internship/Placement – BlackRock >>“Our Summer Internship Program is an 8-week internship designed to deliver an exciting, supportive and fun experience which mirrors life as an Analyst at BlackRock.” << enough said!! Remember, you will have an improved chance of an internship or placement offer if you joined spring week.

Level 4 – Analyst Roles – Full time graduate schemes are open all applicants, but the cohort is finite in size and perhaps 90% (or more!) offers will go to successful interns and placement students. However, open (advertised) analyst level roles are an alternative way to find a job at the end of year 3. Remember, non-core locations are a fantastic place to start your career, and you’ll be in the frame for lateral moves into other lines of business and core cities, so be open minded about where you apply.

Action Three (September-ish) – Let the Games Begin

You’ll have a small window before term starts when a lot of applications will open up. Do not underestimate the investment needed to deliver (dozens of!!) great applications; don’t procrastinate; get them underway!

As the autumn term starts it is important to prioritise and sequence applications, i.e., make sure you budget time for those with the most ‘upside’, those that you have the best chance of success, that you are most aligned with and passionate about.

Finally, I strongly encourage you to think strategically and diversify your portfolio of applications. At BlackRock there are amazing opportunities outside of ‘investing’; say in Portfolio Analytics, Client Services, Marketing, Business Management, Quant & Risk and Financial Modelling. You may have a better chance (i.e. more ‘upside’) in these roles vs the extremely competitive investment teams.

Action Four (December-ish) – Maintain Perspective

The employability game can be brutal, in particular if you are one of the 299 folks rejected for a one Goldman Sachs investment banking position. But of course, if you didn’t crack Goldmans, at least you are in large cohort (including my graduate application in 1997!), join the club!

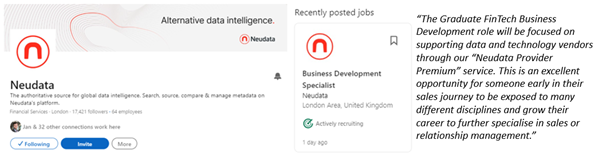

But remember, the game is also subject to the law of large numbers, the more experiments your run the luckier you will get. You have to keep swinging at pitches, eventually you’ll get a hit. And if you are in your final year and had a ‘no hitter’, there may be off cycle graduate jobs at smaller firms that suit you. For example, our good friends at startup Neudata often hire graduates to meet immediate business needs (they have hired two Southampton Graduates off cycle in the past). So, re-tune your LinkedIn searches and keep swinging at pitches!

What Next?

Assuming you did manage to get a hit, you can expect a face-to-face interview or assessment centre. I’ve interviewed a lot in banking, Allspring is my 8th employer! Here we described ‘planning the work’ and getting the applications done and done well. Once you get the interview you really need to ‘work the plan’; execute and get the offer you’re fighting for. That’s what comes next and the topic for part two……………..

By Simon Troup